Explore the pros and cons of Real Estate Vs Stock Market Investment to understand which strategy offers better long-term wealth building and financial stability.

Why Real Estate Outperforms Stock Markets in Long-Term Wealth Building

Boss, let me tell you something straight from the heart – if you’re thinking about where to park your hard-earned money for the long haul, real estate is your best bet. I’ve been in this game since 2005, and trust me, I’ve seen enough market ups and downs to know what works. Today, we’re diving deep into why property investment beats the stock market when it comes to building real wealth. Grab a cup of chai, because we’re about to have a heart-to-heart conversation about your financial future.

The Real Deal: Why Smart Money Chooses Bricks Over Clicks

Let’s cut through the noise, dost. Everyone’s talking about stocks, crypto, and all these fancy investment options, but the ultra-wealthy? They’re quietly building real estate empires. There’s a reason why India’s richest real estate tycoons like K.P. Singh of DLF and Niranjan Hiranandani built multi-billion-dollar fortunes through property. It’s not luck – it’s strategy.

Historical data doesn’t lie, and here’s the truth bomb: while stocks might give you that 10% average annual return, real estate in India has been delivering 8-10% annual appreciation consistently over the past two decades. But wait – that’s just the property value increase. Add rental income to the mix, and you’re looking at total returns that often beat the stock market hands down.

The Power of Tangible Wealth: Something You Can Actually Touch

Picture this scenario – the stock market crashes tomorrow (and it will crash again, mark my words). Your equity portfolio? Gone in smoke. But your property? Still standing strong, still generating rent, still holding value. That’s the beauty of tangible assets, yaar.

Real estate gives you something precious that stocks never can – control and security. When you own property, you’re not at the mercy of some CEO’s bad decisions or market manipulation. You control your asset, you improve it, you manage it, and most importantly, you can see and touch what you own.

The psychological impact is real too. I’ve seen investors sleep peacefully during market crashes because their rental properties kept generating cash flow every month, while their stock-heavy friends were checking portfolio apps every five minutes in panic.

The Triple Advantage: Cash Flow + Appreciation + Tax Benefits

Here’s where real estate becomes absolutely unstoppable, brother. While stocks give you only one potential income source (capital gains or dividends), real estate hits you with a triple combo:

1. Monthly Cash Flow That Actually Grows

Your rental property generates steady monthly income. In cities like Bangalore, a ₹75 lakh property can generate ₹30,000 monthly rent – that’s ₹3.6 lakh annually. And unlike fixed deposits, this income increases with inflation. Try getting that consistency from the stock market.

2. Property Appreciation That Compounds

Property values don’t just go up; they compound over time. That ₹75 lakh Bangalore property? It’s now worth ₹1.4 crore. The beauty is that this appreciation happens on the entire property value, not just your initial investment.

3. Tax Benefits That Stocks Can’t Match

This is where real estate becomes a tax-saving machine. You get:

- Depreciation deductions – claim 5% annually on construction cost for residential properties

- Mortgage interest deductions – every rupee of interest paid is tax-deductible

- Property tax deductions – all maintenance and operating expenses reduce your taxable income

- Capital gains benefits – various exemptions available under different sections

The Leverage Game: Making ₹1 Work Like ₹5

Now here’s where real estate gets absolutely wild – leverage. Banks will happily give you 80% financing to buy property, but try asking them for a loan to buy stocks. Good luck with that.

With just ₹20 lakh down payment, you can control a ₹1 crore property. If that property appreciates by 10%, your ₹20 lakh just became ₹30 lakh – that’s a 50% return on your actual investment. Show me a stock that can guarantee this kind of leverage without margin calls and forced selling.

The best part? As inflation erodes the real value of your loan, you’re essentially paying back tomorrow’s debt with today’s more valuable money.

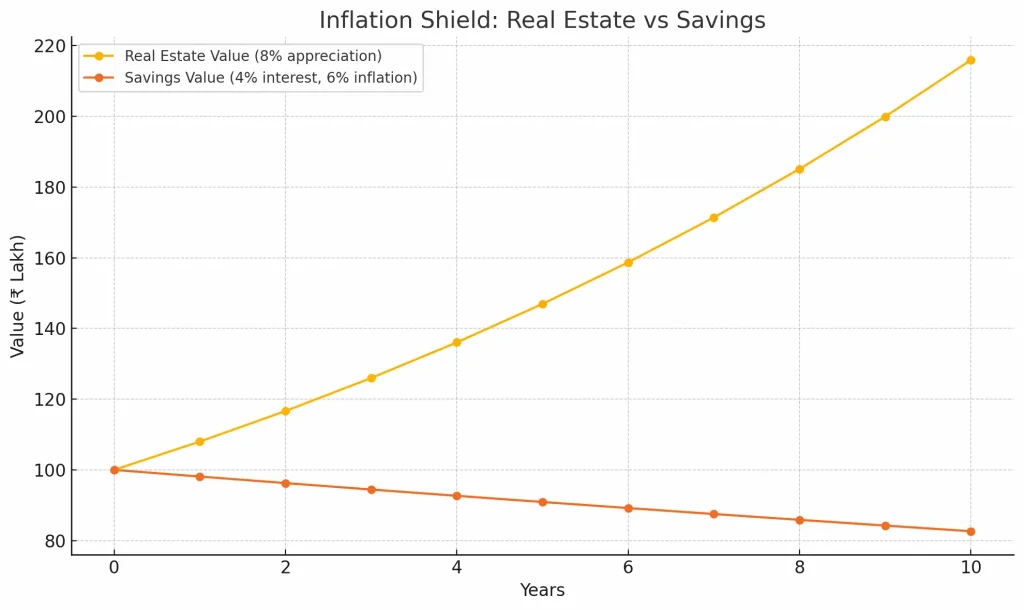

The Inflation Shield: Your Wealth’s Bodyguard

Inflation is the silent killer of wealth, but real estate? It’s inflation’s biggest enemy. As prices rise across the economy, property values and rents typically rise too. Your ₹1 crore property today will be worth much more tomorrow, while that ₹1 crore in a savings account gets weaker every year.

Research shows that real estate has consistently acted as an effective inflation hedge in India. When the cost of building materials, labor, and everything else goes up, your existing properties become more valuable. It’s basic economics, boss.

Stability in an Unstable World: The Tortoise Wins the Race

Stock markets are like that friend who’s super exciting but completely unpredictable. One day you’re rich, next day you’re broke. Real estate? It’s the steady friend who’s always got your back.

Market volatility comparison is stark. In 2023 alone, the Sensex dropped 5% in just one week due to global uncertainties. Meanwhile, property prices in major Indian cities have shown steady 7-10% annual increases over the past decade. The volatility difference is night and day.

During the 2008 financial crisis, stock portfolios got wiped out, but real estate? It recovered and went on to new highs. During COVID-19, while stock markets went crazy, property demand actually increased as people wanted bigger, safer homes.

Compounding Magic: The Secret Sauce of Real Estate Wealth

Most people think compounding only works with mutual funds. Wrong! Real estate compounding is actually more powerful. Here’s how it works:

- Rental income reinvestment: Use rental income to pay down mortgages faster or buy more properties

- Equity buildup: As you pay down loans, you build equity that can be leveraged for more investments

- Property appreciation: The entire property value grows, not just your initial investment

- Leverage multiplication: Your returns compound on the full property value, not just your down payment

A simple example: Buy a ₹50 lakh property with ₹10 lakh down. After 10 years, it’s worth ₹1 crore. Your ₹10 lakh became ₹60 lakh (₹50 lakh appreciation + ₹10 lakh equity). That’s a 6x return, not the 2x you’d expect from the property’s doubling.

The Diversification That Actually Works

Portfolio diversification isn’t just about having different stocks. Real estate offers true diversification because it moves independently of financial markets. When stocks zig, real estate often zags.

You can diversify within real estate too:

- Residential properties in different cities

- Commercial spaces for higher yields

- Land investments for long-term appreciation

- REITs for liquidity when needed

This diversification has saved countless investors during market crashes. While stock portfolios crashed, real estate portfolios provided stability and continued income.

Success Stories: The Proof is in the Pudding

Let’s talk real success, yaar. India’s real estate billionaires didn’t build their wealth through luck. K.P. Singh started as a junior engineer and built DLF into a ₹5.4 billion empire. Niranjan Hiranandani went from chartered accountant to ₹3.3 billion net worth. These aren’t lottery winners – they’re strategic real estate investors who understood the long-term wealth-building power of property.

Even smaller investors are winning big. The case studies are everywhere – people who bought properties in emerging areas and saw 5-10x returns over 15-20 years. Try finding those returns consistently in the stock market without taking massive risks.

The Reality Check: Why Most People Still Choose Stocks

I get it, bro. Stocks seem easier – click a button, buy shares, done. Real estate seems complicated, expensive, and time-consuming. But here’s the reality check:

Easy money rarely builds lasting wealth. Yes, stocks are liquid, yes they’re easier to buy, but that’s exactly why they’re more volatile and risky. The barriers to entry in real estate – the research required, the capital needed, the due diligence – these aren’t bugs, they’re features. They keep out the speculators and create opportunities for serious wealth builders.

Common Myths Busted: Setting the Record Straight

- Myth 1: “Real estate is illiquid”

Reality: So what? Wealth building is about long-term thinking, not day trading. The best investments are the ones you can’t panic-sell during market downturns. - Myth 2: “Property management is too much work”

Reality: Hire a property manager for 5-8% of rental income. Still leaves you with better returns than most mutual funds. - Myth 3: “You need huge money to start”

Reality: With 80% financing available, you can start with just 20% down payment. That’s more accessible than people think. - Myth 4: “Real estate returns are lower than stocks”

Reality: When you factor in rental income, tax benefits, and leverage, real estate often outperforms stocks with much lower risk.

Your Action Plan: How to Start Building Real Estate Wealth

Listen carefully, because this is where the rubber meets the road:

- Step 1: Education First: Before buying anything, understand your local market. Study price trends, rental yields, and upcoming developments. Knowledge is your biggest asset.

- Step 2: Start with Your Primary Residence: Stop paying rent! Convert that monthly rent into EMI for your own property. It’s the same cash outflow but builds your wealth instead of your landlord’s.

- Step 3: Choose the Right Location: Location, location, location – this isn’t just a cliché, it’s the fundamental truth of real estate. Buy in areas with:

- Good infrastructure and connectivity

- Upcoming development projects

- Strong rental demand

- Potential for appreciation

- Step 4: Leverage Smartly: Use bank loans to your advantage, but don’t overleverage. Keep debt-to-income ratios manageable and always have emergency reserves.

- Step 5: Think Long-term: Real estate wealth building requires patience. Don’t expect quick profits – expect steady, compounding returns over decades.

The Bottom Line: Your Wealth, Your Choice

Boss, I’ve been in this game long enough to see both market crashes and real estate cycles. The one constant? People who built serious wealth through real estate stayed wealthy. They sleep better at night, have steady cash flow, and aren’t checking apps every minute for stock prices.

Stock markets will continue to be volatile, unpredictable, and stressful. Real estate will continue to be stable, income-generating, and wealth-building. The choice is yours.

But here’s my personal recommendation: Don’t choose one or the other. Build your foundation with real estate (70-80% of your investment portfolio) and use stocks for the remaining 20-30%. This gives you stability from property and growth potential from equities.

Real estate isn’t just about buying a house – it’s about buying your financial freedom. It’s about creating wealth that lasts generations, not just market cycles. It’s about building something tangible in an increasingly digital world.

The wealthy understand this. The question is: when will you?

Remember, dost – you don’t get rich by saving money. You get rich by investing money. And if you’re going to invest, invest in something you can see, touch, control, and improve. Invest in real estate.

Start small, think big, and be patient. Your future self will thank you.

Ready to start your real estate wealth-building journey? The best time to plant a tree was 20 years ago. The second-best time is today. Don’t wait for the “perfect” moment – it never comes. Take action now, because in 20 years, you’ll wish you had started today.